:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2166872794-eb227e709b2f4b22b25f0e3e56ed1054.jpg)

AJ Mast / Bloomberg via Getty Images

Eli Lilly (LLY) shares tumbled 12% at the opening bell Wednesday after its third-quarter results fell well short of analysts’ estimates and it lowered its full-year guidance.

The pharmaceutical giant registered $11.44 billion in revenue—above last year’s $9.50 billion but below the $12.18 billion consensus estimate of analysts polled by Visible Alpha—as weight-loss drugs Mounjaro and Zepbound continue to boost Eli Lilly’s sales. However, analysts were looking for greater sales of the blockbuster drugs.

Lilly swung to a profit of $970.3 million, or $1.07 per share, but still well below the $1.69 billion and $1.87 per share analysts were looking for. Adjusted EPS of $1.18 was barely half of the $2.18 expected.

Lilly Lowers 2024 Outlook

Lilly lowered its 2024 earnings per share (EPS) guidance to a range of $12.05 to $12.55 from $15.10 to $15.60, and adjusted EPS to $13.02 to $13.52 from $16.10 to $16.60. These were both driven by the $2.83 billion acquired in-progress research and development (IPR&D) charges incurred in Q3.

Lilly also lowered the top of its full-year revenue range to $46.0 billion from $46.6 billion.

Lilly and Danish rival Novo Nordisk (NVO)—which has its own blockbuster drugs in Ozempic and Wegovy—have spent billions on a variety of acquisitions to help ramp up production of their weight-loss medications.

Weight-Loss Drugs Have Powered Lilly, Novo Nordisk Results

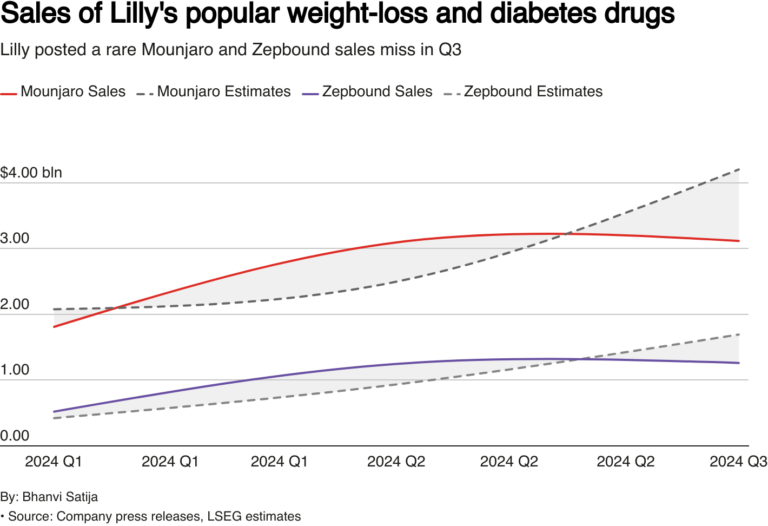

Surging sales for the weight-loss drugs have boosted Eli Lilly and Novo Nordisk’s results over the last several quarters. Eli Lilly said sales of Mounjaro more than doubled year-over-year to $3.11 billion, while Zepbound produced $1.26 billion in quarterly sales as it approaches its one-year anniversary of Food and Drug Administration (FDA) approval.

However, analysts were looking for $3.69 billion in Mounjaro revenue and $1.71 billion in Zepbound sales.

Eli Lilly shares, which had been up more than 50% since the start of the year through Tuesday’s close, fell 12% to $792.42 at the opening bell. Novo Nordisk stock fell more than 3%.

UPDATE—This story has been updated with the latest share price and guidance information.